AsianFin -- Europe is fast becoming a key battleground for Chinese companies in the global race to expand the new energy supply chain, as policy shifts, energy security concerns, and industrial cooperation drive cross-border investment.

On July 24, China and the European Union issued a joint statement on climate change, pledging to accelerate renewable energy deployment and deepen cooperation in green and low-carbon technologies. The agreement underscores how the green economy and energy transition have become core themes in bilateral relations.

Over the past few years, Chinese firms in solar, energy storage, and electric vehicles have moved beyond exporting products to building local production, sales, and service networks in Europe. Battery giant CATL has invested in plants in Germany, Hungary, and Spain; Gotion High-Tech has established operations in Slovakia; and BYD has expanded its electric commercial vehicle plant in Hungary. Chinese automotive parts exports to the EU rose 9.7% year-on-year in the first half of 2025, customs data show.

Europe』s draw has only strengthened amid the U.S. Inflation Reduction Act and uncertainty over U.S. tariffs. 「Now is the best time for Chinese companies to expand into Europe,」 said Sun Tianlu, founder of Roadlink GLB, following a month-long research trip. She also noted local concerns over Chinese market dominance, stressing the need for integration with European ecosystems.

The Russia-Ukraine conflict has accelerated the EU』s push for renewable energy to both cut emissions and reduce reliance on imports. In a June review of its 「REPowerEU」 plan, the EU said nearly €300 billion had been mobilized for green initiatives in three years.

Solar installations surged in 2022 and 2023, but growth slowed to 4.4% in 2024 and is forecast to contract in 2025 for the first time in a decade, according to SolarPower Europe. Chinese PV exports to Europe fell 12.3% in the first half of 2025.

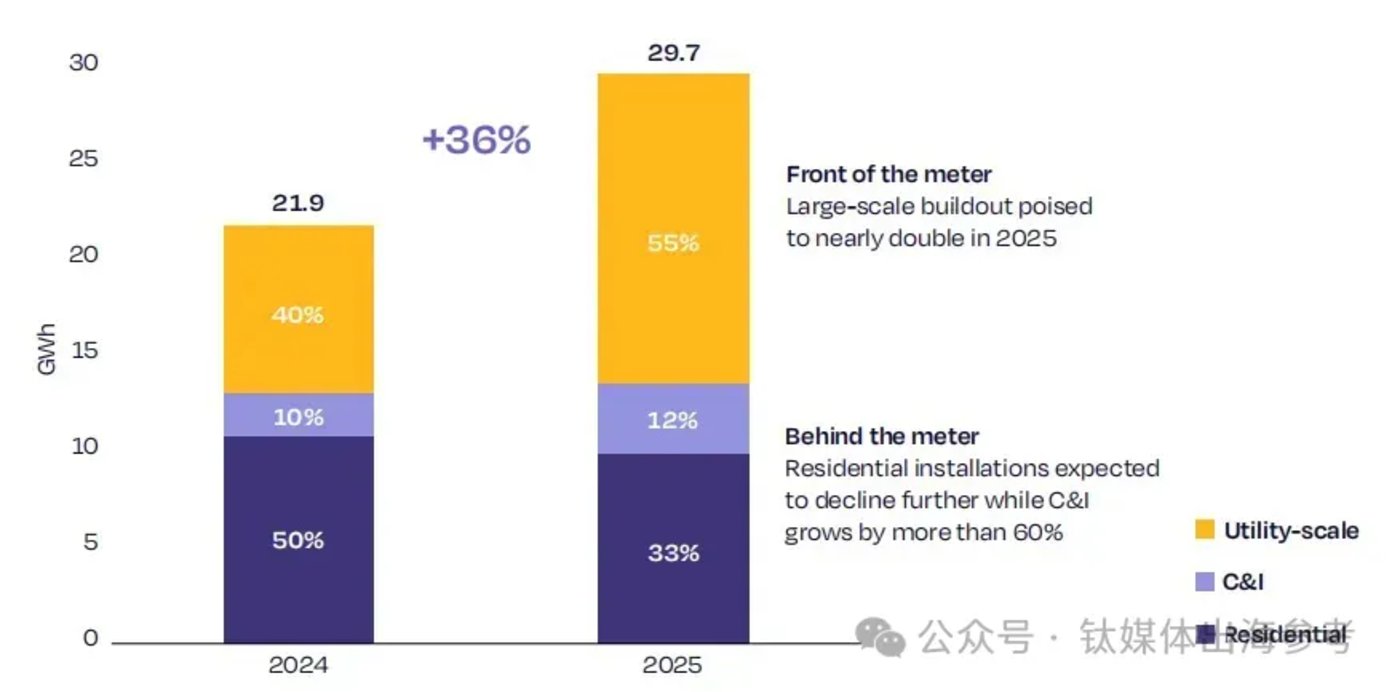

Energy storage is now emerging as the sector』s growth engine. The EU targets 500–780 GWh of installed storage capacity by 2030—up to 10 times current levels. While residential storage has dominated to date, 2024 marked the first year grid-scale capacity surpassed user-side capacity. SolarPower Europe projects 29.7 GWh of new storage in 2025, with utility-scale demand rising 55%.

Chinese suppliers are moving quickly. Trina Storage signed a deal with Lithuania』s Stiemo to deploy GWh-scale storage in Eastern Europe. Sungrow partnered with Bulgaria』s Sunotec on 2.4 GWh of projects, while Hithium will supply 720 MWh to UK developer Elements Green.

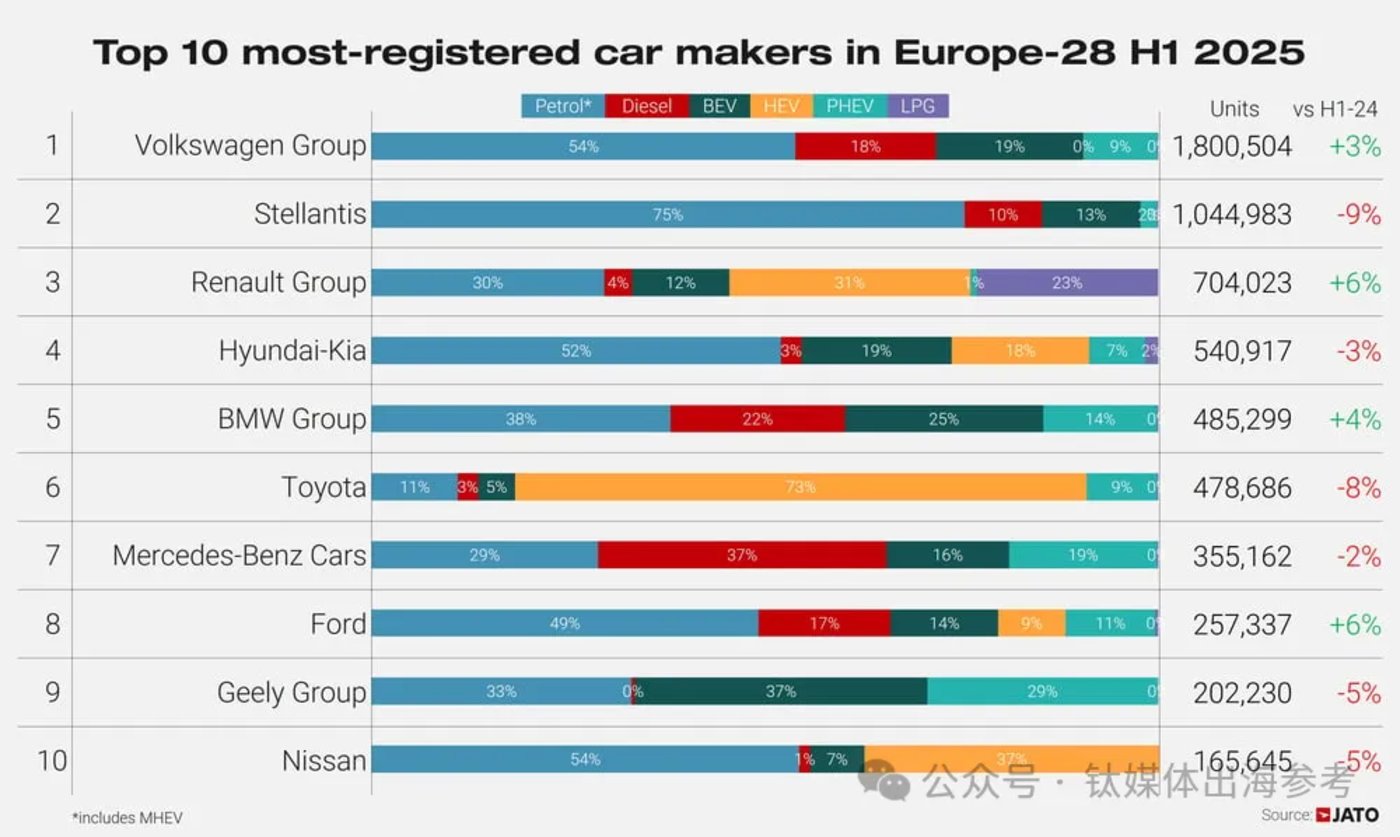

Chinese automakers sold 347,135 vehicles in Europe in the first half, up 91% year-on-year, lifting their market share to 5.1%—ahead of Ford, according to Jato Dynamics. The surge comes despite EU anti-subsidy tariffs on Chinese EVs of up to 35.3%, which do not apply to plug-in hybrids (PHEVs).

PHEVs accounted for 41% of BYD』s European sales in March, helping it overtake Tesla in April and Mercedes-Benz in June. Chery』s plug-in hybrids made up 71% of March sales, with the segment』s shipments to Europe soaring 368% in the first quarter. Brands from Geely to XPeng are also gaining ground, buoying suppliers from Desay SV to charging station manufacturers, whose exports to Germany have surged.

Europe』s strict regulatory environment poses challenges for newcomers. Companies face complex compliance demands, from extended producer responsibility (EPR) rules on batteries to intellectual property litigation.

Sun likened Europe to 「the Thirteen Protectors of Jiangsu,」 emphasizing the need for tailored strategies for each market and professional partners with cross-border expertise. Talent shortages—particularly managers versed in both technology and local market dynamics—remain a major constraint.

For Chinese new energy firms, Europe offers both a stable demand base and the chance to shape market rules. But success will require moving from passive compliance to active participation in regulation, building international teams, and embedding global operations in local markets.

If you』d like, I can also prepare a short, market-facing version of this that would fit on a Bloomberg terminal headline and 1–2 lead paragraphs for quick trader consumption. That would give you both a deep-dive and a wire-ready alert.