TMTPOST -- The White House on Friday dismissed reported new tariffs on gold imports from Switzerland, which had thrown bullion markets into turmoil.

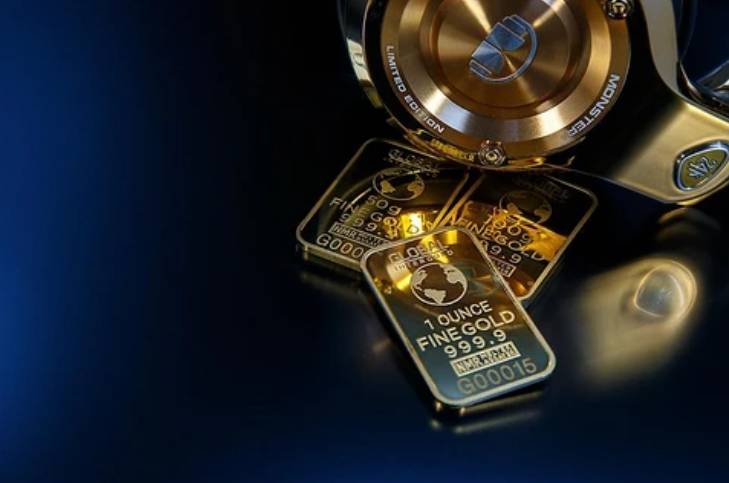

Credit:Xinhua News Agency

The Trump administration suggested it would issue a new policy clarifying that imports of gold bars should not face tariffs, Bloomberg reported. 「The White House intends to issue an executive order in the near future clarifying misinformation about the tariffing of gold bars and other speciality products,」 the report cited a White House official.

U.S. gold futures for December delivery briefly pared gains at midday after the reported White House』s clarification, but was immediately bid back up. The gold futures earlier Friday topped $3534.00, hitting an all-time high over a Financial Times (FT) report about gold tariffs shocked traders who had assumed gold bars met the definition of 「bullion」 would still be exempted despite new tariffs on Switzerland.

U.S. President Donald Trump on July 31 signed an executive order to modify reciprocal tariffs on dozens of countries, with the tariff rates ranging from 10% to 41%. Switzerland is one of losers as Trump lifted the 31% reciprocal tariff rate on the country to 39%, effective on Thursday.

The FT report implies that gold imported from refiners in Switzerland is subject to a 39% import tariff, citing one of ruling letters that are used by the U.S. government to clarify its trade policy.

A Swiss refiner asked the U.S. Customs Border Protection (CBP) agency whether the cast bar they produce, and potentially export to the US, falls under HS code 7108.12.10, and are therefore exempt under Annex 2 of the Liberation Day Executive Order.

The agency said one-kilo and 100-ounce gold bars should be classified under a customs code 7108.13.5500, and are therefore subject to tariffs, because they are 「stamped」, meaning they are not unwrought, according to a so-called ruling letter dated July 31, which was seen by the FT.

As the world』s top gold refining hub, Switzerland refines 90% of gold sourced from industrial mines. Gold is set to become significantly more expensive in the U.S. than in the international market if the reciprocal tariffs apply to gold bars.

UBS strategist Joni Teves said the gold tariffs were surprising, given most Swiss gold imports to the U.S. had historically been tariff exempt. One-kilo gold bars are the most common form of the metal traded on metals-trading exchange Comex.

The global gold market relies on futures traded on Comex to hedge its positions, with the assumption that metals can easily be imported U.S. warehouses to settle contracts if necessary, according to the strategist.

「The imposition of tariffs on these gold cast products makes it economically unviable to export them to the U.S., thereby eliminating any future trade deficit arising from gold exports,」 said the Swiss Association of Manufacturers and Traders of Precious Metals in a statement. The association said it remains committed to a 「constructive」 dialogue with U.S. authorities and international partners.

Trump last week has stirred market volatility with his new metal tariffs. The president on July 30 signed a proclamation,imposing a 50% tariff on semi-finished copper products, intensive copper derivative products, and certain other copper derivatives on August 1. Unlike his threat earlier July, the order on July 30 didn』t affect the raw material itself.

That means it excluded copper scrap and copper input materials, and only apply to copper products such pipes, tubes and other semi-finished copper products, as well as products that copper is heavily used to manufacture, including cable and electrical components. The copper tariff won』t be added to auto levies.

U.S. copper futures tumbled as much as around 20% in after-hours on July 30 following an announcement of adjusting imports of copper into the United States. And next day saw the metal finished 22% lower, logging ts biggest daily decline in records dating back to 1968.