(Image Source: Unsplash)

AsianFin -- OpenAI and Microsoft are renegotiating the terms of their multibillion-dollar alliance in a move that could clear a path for the ChatGPT creator to go public, while preserving Microsoft』s access to cutting-edge AI technology, the Financial Timesreported Sunday.

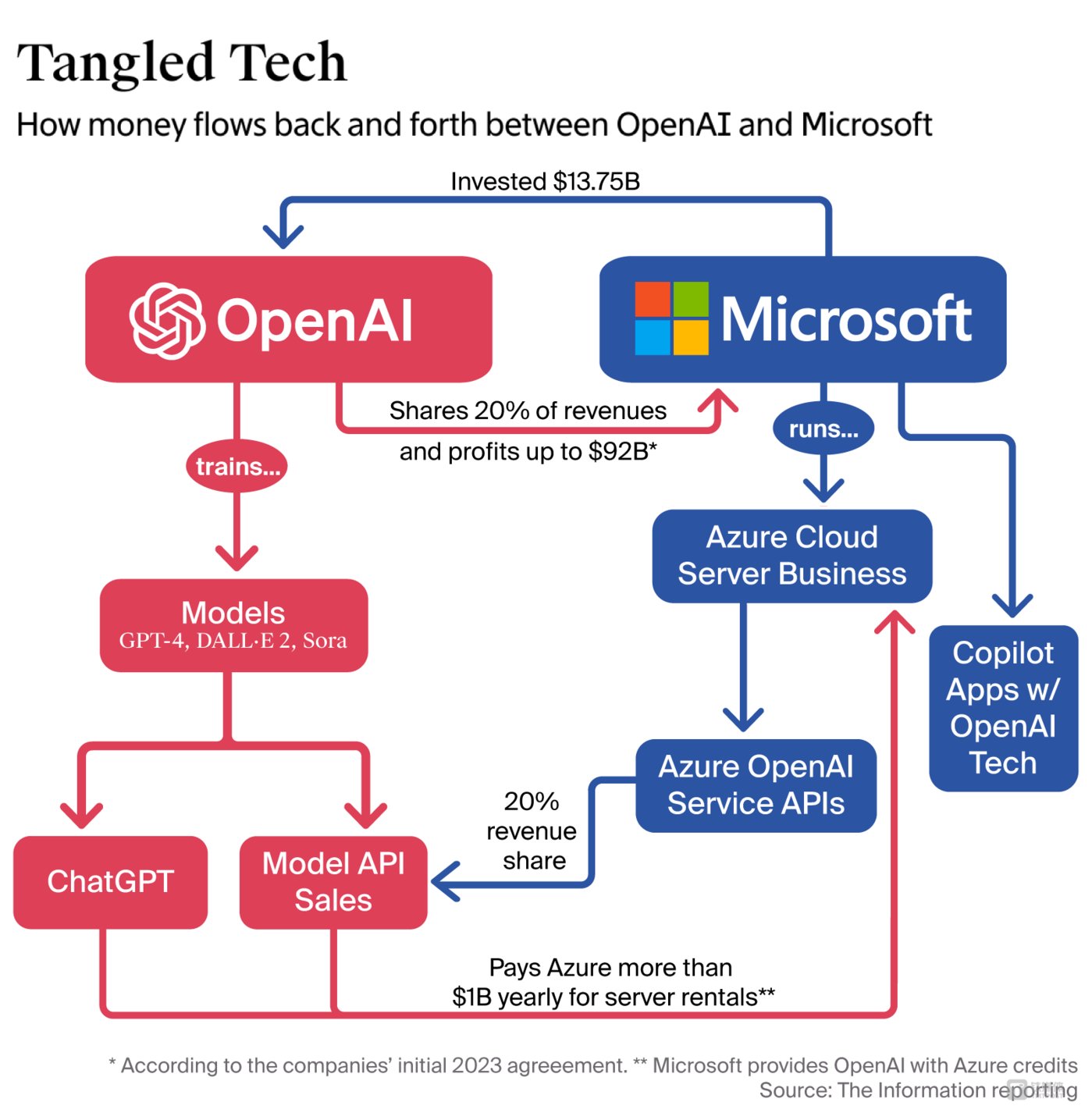

At the heart of the talks is Microsoft』s more than $13 billion investment in OpenAI and how much equity it will hold in the company』s restructured for-profit arm. According to the report, Microsoft is willing to give up part of its stake in exchange for extended rights to AI technologies developed beyond the current 2030 licensing cutoff.

The two sides are also reworking a broader commercial agreement that dates back to 2019, when Microsoft made its initial $1 billion bet on OpenAI.

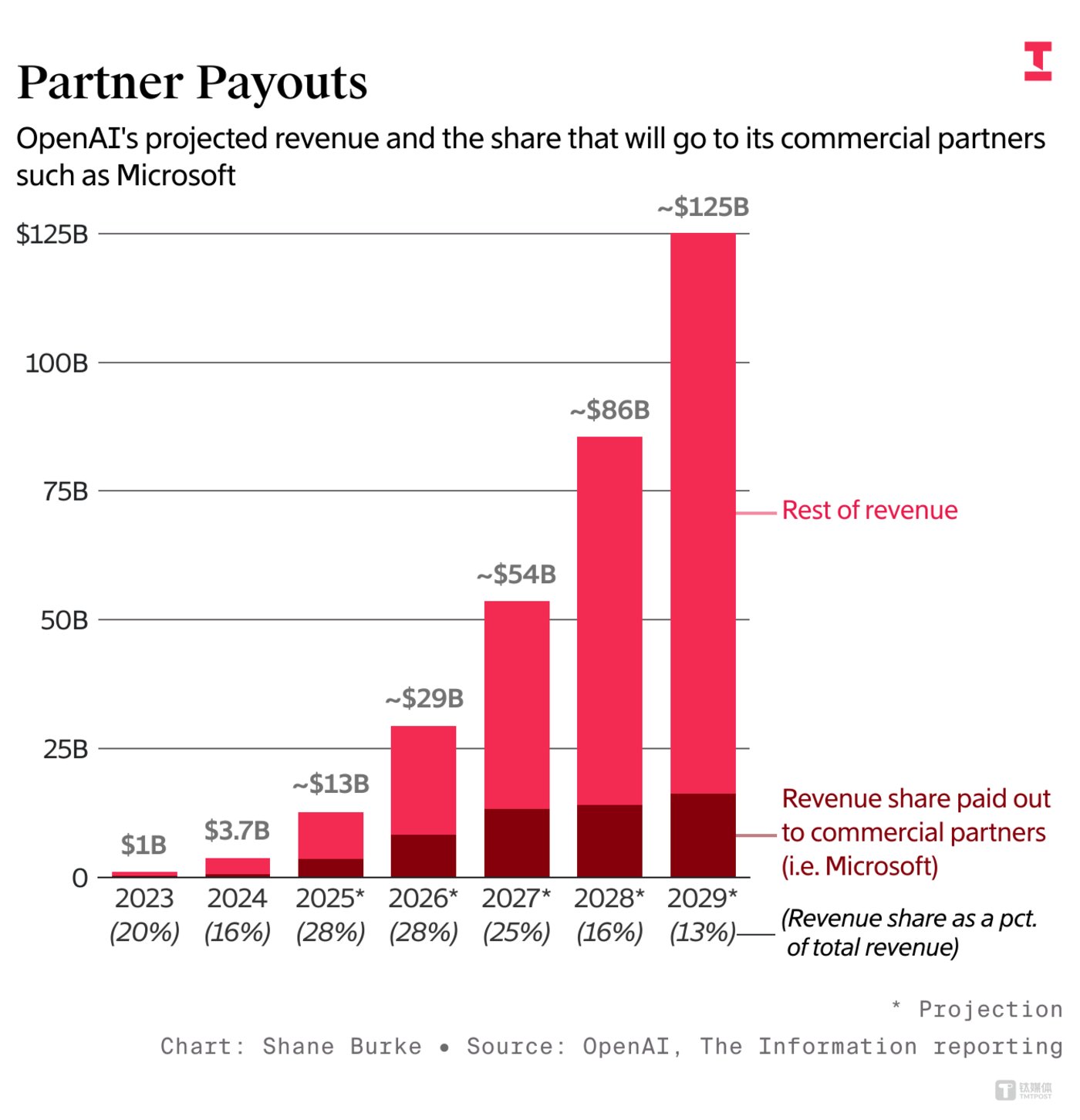

The talks come as OpenAI prepares for a potential initial public offering and streamlines its revenue-sharing model. Last week, The Information reported that the company told investors it will reduce the percentage of revenue shared with Microsoft as part of the restructuring.

In January, Microsoft modified aspects of its agreement with OpenAI after entering a massive joint venture with Oracle and Japan』s SoftBank to build up to $500 billion worth of AI data centers across the United States.

Microsoft Can't Replicate OpenAI's Success

On the first trading day of May, Microsoft overtook Apple to reclaim its position as the world』s most valuable technology company by market capitalization.

The software giant』s resilience in a turbulent macroeconomic environment is largely attributed to the robust performance of its cloud business and the relative insulation of software from tariffs in the ongoing global trade tensions. These advantages have helped Microsoft maintain its growth trajectory while others faltered.

CEO Satya Nadella has emphasized the defensive nature of enterprise software amid inflation and slowing economic growth. 「Software is the best resource to combat inflation and the pressures of slowing economic growth, enabling higher efficiency and low-cost development,」 Nadella said.

Yet, Microsoft's AI strategy faces potential headwinds due to the increasingly complex relationship with its key partner, OpenAI.

OpenAI, co-founded in 2015 by Sam Altman, Elon Musk, and others with over $1 billion in pledged investments, began working closely with Microsoft just a year later. Azure became OpenAI』s default cloud platform, forming the backbone for its large-scale AI research and development.

In 2019, as OpenAI transitioned toward commercialization and Altman took the reins following Musk』s departure, Microsoft invested $1 billion and became OpenAI』s exclusive cloud and licensing partner. The two firms committed to co-develop next-generation Azure AI supercomputing infrastructure.

Microsoft doubled down with another $2 billion investment in 2021, rolling out products such as GitHub Copilot and Azure OpenAI Services. Then, following the explosive debut of ChatGPT in November 2022—which amassed over 100 million users in two months—Microsoft injected an additional $13 billion into OpenAI. At its peak, ChatGPT generated more than $3 billion in annualized revenue and surpassed 20 million paid users.

But by 2025, market dynamics began to shift.

China's DeepSeek, an open-source AI model, gained global traction. OpenAI faced executive departures, and its latest inference models failed to impress. Meanwhile, legal disputes involving Elon Musk resurfaced, and investor focus pivoted to AI infrastructure and real-world application ecosystems. The competitive landscape began to display signs of consolidation, with dominant players edging out the rest.

In February, OpenAI launched 「Stargate,」 a joint venture in the U.S. with Japan』s SoftBank Group, Oracle, MGX, and others. Backed initially by $100 billion—with SoftBank already investing several billion—the fund aims to scale up to $500 billion over the next four years.

To further accelerate commercialization, OpenAI announced a major restructuring in March. The company revealed plans to raise $40 billion from institutional backers including SoftBank, which secured a conditional "betting clause" that values OpenAI at $300 billion (approx. 2.1 trillion RMB). The clause allows SoftBank to halve its investment to $20 billion if OpenAI fails to convert to a public benefit corporation (PBC) by the end of 2025.

Microsoft is increasingly forging its own path in AI model development, adopting a strategy that balances collaboration and competition with OpenAI. The strategic shift reflects evolving priorities and changing mindsets among the companies』 leadership.

Currently, OpenAI reports over 500 million weekly active users, up from 300 million in December 2024. Yet, Microsoft has been quietly building its own AI muscle.

In March 2024, Microsoft CEO Satya Nadella made a pivotal move by bringing on board Demis Hassabis, the renowned AI scientist and founder of Google DeepMind and Inflection AI. Microsoft paid $650 million to license Inflection』s technologies and acquire its research team. Soon after, Hassabis was named CEO of Microsoft AI.

Hassabis quickly consolidated Microsoft』s fragmented AI efforts into a unified model development division led by Inflection』s co-founder and Chief Scientist, Alex Simonyan. Under his leadership, Microsoft has been developing its own large-scale models—internally called MAI—which are said to rival those from OpenAI and Anthropic. The company also integrates models from Anthropic, xAI, DeepSeek, and Meta to enhance its Copilot assistant.

「This is an era of fierce competition and limitless innovation,」 Hassabis said. 「We』re evaluating every model from every major lab, including open-source options. What we』re building will surprise many.」

Hassabis has also pushed Microsoft to accelerate work on AI reasoning models. In mid-2024, tensions emerged when he questioned OpenAI』s transparency around its o1 Chain of Thought model. Frustrated by a lack of technical documentation, Microsoft began training its own reasoning models—although progress has been slower than hoped. Meanwhile, OpenAI has kept pace, rolling out its GPT-4.5 and o3 preview models in quick succession.

AI Chief Mustafa Suleyman emphasized that Microsoft』s priority is long-term self-reliance in AI. 「We』re focused on the next decade,」 he said. 「Our goal is to ensure Microsoft builds the internal capabilities to develop world-class models and collaborate on using the best ones available.」

OpenAI is doubling down on AI coding tools, announcing a $3 billion deal to acquire Windsurf (formerly Codeium), marking its largest acquisition to date.

Founded in 2021 by MIT alumni Varun Mohan and Douglas Chen, Windsurf has grown rapidly, securing $243 million in funding and reaching a $1.25 billion valuation. With annual recurring revenue of around $40 million, the acquisition aims to reinforce OpenAI』s competitive edge in the booming AI programming assistant space.

Meanwhile, Anysphere—the parent company of AI coding tool Cursor—has raised $900 million in a funding round led by Thrive Capital, with participation from Andreessen Horowitz and Accel. Cursor』s ARR has hit $300 million, and the company has twice rejected OpenAI』s acquisition offers, signaling its confidence in independence.

The AI coding sector has emerged as a hotbed for commercialization, thanks to clear revenue potential and growing demand. OceanBase CTO Yang Chuanhui told TMTPost that generative AI is already handling repetitive development tasks, urging developers to embrace AI tools or risk falling behind.

Microsoft is already reaping benefits: Nadella recently said that 20–30% of the company』s codebase is now AI-generated. He stressed that the long-term value in AI lies in computation and reasoning capabilities. 「This isn』t just a model race—it』s about building tools that power economic growth,」 Nadella noted, while cautioning that AI won』t fully replace human cognitive work.

Deloitte』s latest China High-Tech High-Growth 50 and Rising Stars report underscores AI』s role as a critical post-digitalization productivity driver. Cheng Zhong, Managing Partner of Deloitte China's TMT industry practice, noted that more than half of the shortlisted firms now focus their R&D on AI and machine learning.

The report highlights rapid advances in generative AI across applications like text-to-image/video, content generation, and AI-enhanced music and design. While most current use cases are B2B, consumer applications—particularly AI+education—are gaining ground, with law, finance, and healthcare also showing strong potential.

At the 27th China Beijing International High-Tech Expo, Deloitte launched its 2025 「China Technology Fast 50 and Rising Star」 program, an annual global initiative recognizing top innovators. Past winners include tech giants like Microsoft, Apple, Alibaba, Tencent, and ByteDance.

Zhao Jindong, National Managing Partner of Deloitte』s Fast 50 program, said leading companies consistently share traits such as AI investment, R&D intensity, sustainability, and ecosystem collaboration—qualities that will define future tech leadership.

On the path to commercialization, OpenAI is poised to begin generating substantial revenue from its free user base and new product lines starting next year. The company has informed current and prospective investors that by around 2030, revenue from AI agents and emerging product categories is expected to surpass that of ChatGPT, its flagship chatbot. Projections indicate OpenAI』s total revenue could reach $125 billion by 2029, rising to $174 billion by 2030.

According to the Financial Times, OpenAI is preparing to renegotiate its agreement with Microsoft, which currently includes access to OpenAI』s IP—such as its large language models and AI technologies—and a revenue-sharing arrangement. The proposed revision could reduce Microsoft』s revenue share from 28% to 10%. In return, Microsoft is reportedly considering giving up a portion of its equity stake in OpenAI』s for-profit entity to maintain access to future technologies developed beyond 2030.

Meanwhile, Microsoft』s latest earnings report reveals that its annual revenue from AI-related products has surpassed $13 billion—12 times higher than the monthly figure from the prior period—exceeding market expectations. This surge is primarily driven by Azure cloud services, enterprise subscriptions to Office 365, and AI tools for developers, including GitHub Copilot.