(Image Source: Shutterstock US)

AsianFin -- Major technology and semiconductor stocks have taken a major hit since U.S. President Donald Trump announced steep "reciprocal" tariffs against almost all trading partners.

At Monday's close, U.S.-listed shares of tech titans saw sharp declines. Apple plunged 3.67%, Intel fell 1.41%, and TSMC's ADRs slipped 0.43%. In Asian markets, Taiwan's TSMC nosedived more than 9% to its daily limit, while Foxconn and MediaTek also closed at their lower limit. In Hong Kong, Lenovo tumbled 22.89% and SMIC sank over 16%.

According to market data, the U.S. stock market evaporized over $6 trillion in market capitalization between April 3 and 4. The combined valuation of the "Big Seven" — Apple, Microsoft, Amazon, Tesla, Meta, Nvidia, and Google — plummeted by over $1.8 trillion. Apple alone has shed 19% over three trading sessions, erasing $638 billion in market value. Nvidia lost more than 10% this week, wiping out over $260 billion from its market value.

The market turmoil follows Trump's renewed push for aggressive chip tariffs. Earlier this year, Trump floated levies of up to 100% on advanced semiconductor imports. While that move was temporarily delayed following TSMC's $100 billion U.S. investment pledge, the administration has now signaled that tariffs on up to $521 billion worth of chip-related goods — from machinery to automotive semiconductors — could be subject to tariff rates as high as 49%.

While $82 billion in imported chips may be exempt for now, it's the broader ecosystem — machinery, components, and electronics — that is most vulnerable, analysts at Goldman Sachs wrote in a note.

These costs will ultimately be passed to consumers and squeeze margins across the AI and chip sectors, they added.

On April 4, Beijing announced a retaliatory 34% tariff on all U.S. imports — including chips, semiconductor equipment, and medical devices — set to take effect on April 10. A slew of measures followed, including export restrictions on rare earths, World Trade Organization (WTO) filings, and export license suspensions for key U.S. tech firms.

Apple, Nvidia in the Crosshairs

Apple has become a focal point in the tariff war. Morgan Stanley estimates new U.S. tariffs could cost Apple $8.5 billion annually, raising the iPhone 16 Pro's component costs from $549 to $846. If passed on to consumers, the iPhone 16 Pro Max could retail for as much as $2,300, up from $1,599.

Bloomberg reports Apple shipped five plane-loads of inventory from India to the U.S. in late March to beat the tariff deadline. Still, analysts say future models — especially the iPhone 17 series — could see price hikes.

The report pointed out that Apple will not raise prices in the short term, and the current product inventory can last for a while. The iPhone 17 series in September may see a price increase. For investors, the impact is significant. The increase in component costs may squeeze the profit margins of companies like Apple.

These companies may choose to absorb part of the costs or pass them on to consumers. This may lead to a slowdown in the growth of the electronics industry and may affect the broader economy.

Analysts have warned that tariffs may fuel inflation, leading to price increases of various consumer goods. The National Retail Federation has warned that the proposed tariffs may drive up inflation and prices, resulting in job losses.

In fact, it was during Trump's first term that Apple began to promote the diversification of its supply chain. This included transferring part of the production of mobile phones and earphones from China to India, moving part of the production of earphones, watches, and computers to Vietnam, and adding computer product production lines in Malaysia and Thailand.

However, now, as the United States plans to generally impose high "reciprocal tariffs" on Southeast Asian countries, it will undoubtedly deal a heavy blow to Apple's supply chain. Therefore, there are reports indicating that Apple plans to shift the production of the iPhone 16 to Brazil to reduce the impact of the additional tariffs.

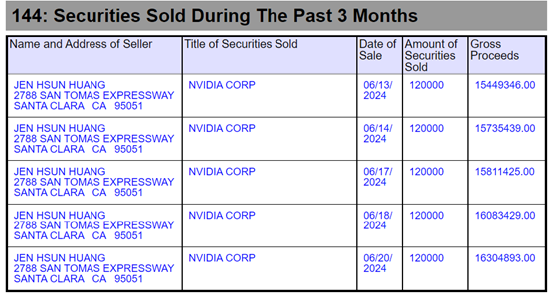

The squeeze isn't limited to consumer electronics. Nvidia, which has a 75% gross margin on its $50,000 AI GPUs, may face up to $3,125 in new import taxes per unit. The company could see eroded profitability or may pass on costs, further fueling inflationary concerns.

While tariffs raise import costs, they are also accelerating China's efforts to localize chip production. At the Zhongguancun Forum in March, Loongson debuted its fully domestic 3C6000/D server chip, reportedly featuring a performance as good as Intel's Xeon Gold 6338. The company posted revenue of 506 million yuan in 2024.

Imports data underscores the shifting landscape. China imported $11.8 billion worth of U.S. integrated circuits in 2024, accounting for just 3.04% of its total chip imports. However, semiconductor manufacturing equipment and components — which are harder to replace — made up nearly 10%.

China』s southwestern Sichuan province was the destination to the largest amount of integrated circuits and semiconductor devices imported in 2024 from the United States, which hit 62.433 billion yuan in value and accounted for nearly 70% of China』s imports of the kind

It is reported that domestic consumer electronics industry chain enterprises such as Foxconn, Compal Electronics, TCL, BOE Technology Group, and Changhong, which are involved in smart phones, display screens and other products, are all concentrated in Sichuan province.

In addition, American enterprises such as Intel and Texas Instruments have investment and construction bases in Sichuan. Therefore, the additional 34% tariff may have a certain impact on the electronic information industry in Sichuan province. In addition, Guangdong province, Shanghai municipality, and Jiangsu province are also regions in China that import a relatively large amount of semiconductor equipment and components from the United States.

The increase in tariffs will further prompt the above regions to accelerate the substitution process of the domestic semiconductor supply chain, in order to reduce the impact of tariffs on the supply chain costs.

Gao Shiwang, Director of the Shanghai Home Appliance and Electronic Products Branch of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, said that currently, enterprises are in a wait-and-see state regarding the respective tariff increase policies of China and the United States, and it is expected that relevant policies may still change in the future.

Secondly, from the perspective of the industrial chain layout, the global upstream and downstream industrial chains of chips, including chip design, manufacturing, packaging, equipment, and materials, will all be affected to a certain extent.

For example, enterprises such as Apple, Intel, Texas Instruments, Micron Technology, Analog Devices (ADI), Microchip Technology, and ON Semiconductor all have wafer factories and facilities in the United States or globally. Once they export finished products to China, they may be affected by the additional tariffs.

Regarding the import of key products, the import and export structure of China's chip products is similar, mainly including integrated circuits and semiconductor device products, such as processors and controllers, memories, analog/power semiconductors. Therefore, if a 34% tariff is imposed on imports from the United States, some domestic PC manufacturers and server manufacturers may be affected by the increase in costs, but it can also accelerate the substitution of domestic CPU and MCU products.

At the equipment level, the import of semiconductor equipment and components mainly consists of front-end manufacturing equipment, and the proportion of imports from the United States reaches 12.7%. Therefore, the 34% tariff may affect some domestic foundries that have not yet completed the purchase of semiconductor equipment, as well as second-hand equipment manufacturers engaged in the business of American semiconductor equipment.

TSMC is betting big on the U.S. market, announcing plans to increase its investment in the U.S. from $100 billion to $165 billion. This includes six new facilities — three fabs, two packaging plants, and a research center. TSMC's Arizona plant, now producing 4nm chips for Apple and Nvidia, is a cornerstone of the strategy.

In a surprise twist, Intel and TSMC are reportedly in talks to form a joint venture to operate Intel's U.S. fabs. Under the deal, TSMC would take a 20% stake and transfer key process technologies to Intel staff.

"Millions once assembled iPhones in China — now, automation and American technicians will take over," said U.S. Commerce Secretary Howard Lutnick.

China Draws a Line in the Sand

Chinese Foreign Ministry spokesperson Lin Jian accused Washington of "economic bullying," saying that the tariffs violate WTO rules and harm global economic stability.

"China stands ready to defend multilateralism and international fairness. We urge the U.S. to abandon unilateralism and return to the path of cooperation," Lin said.

Meanwhile, Beijing is doubling down on countermeasures, launching antitrust investigations into Google, Nvidia, and other U.S. firms while limiting imports of U.S. agricultural and natural resources.

The global chip war has entered a new phase. With tariff escalation on both sides, global supply chains face severe disruption. While the U.S. aims to repatriate chip manufacturing, China is moving rapidly to build resilience through domestic innovation and industrial self-reliance. For global tech and chip giants, the new normal is one of rising costs, political risk, and an urgent need to rethink global production strategies.